-

Consumers are about to feel the impact of soaring bond yields, Blackstone president Jonathan Gray told the FT.

-

The yield on the 10-year US Treasury continued to rise on Thursday, edging closer to 5%.

-

Higher bond yields are raising borrowing costs all over the economy, from mortgages to personal loans.

American consumers are on the brink of experiencing the impact of surging bond yields, according to Jonathan Gray, President of Blackstone. This warning comes as bond yields, which affect borrowing costs for various loan products, increased this week due to concerns about higher interest rates. The yield on the 10-year Treasury bond rose to 4.958% on Thursday, marking its highest level in 16 years.

In an interview with the Financial Times, Gray stated, “When 30-year mortgages and car loans cost you 8 percent it will impact consumer behavior.” He also expressed concerns that if current policy remains restrictive for an extended period, it could inevitably lead to an economic slowdown, despite the economy demonstrating remarkable resilience.

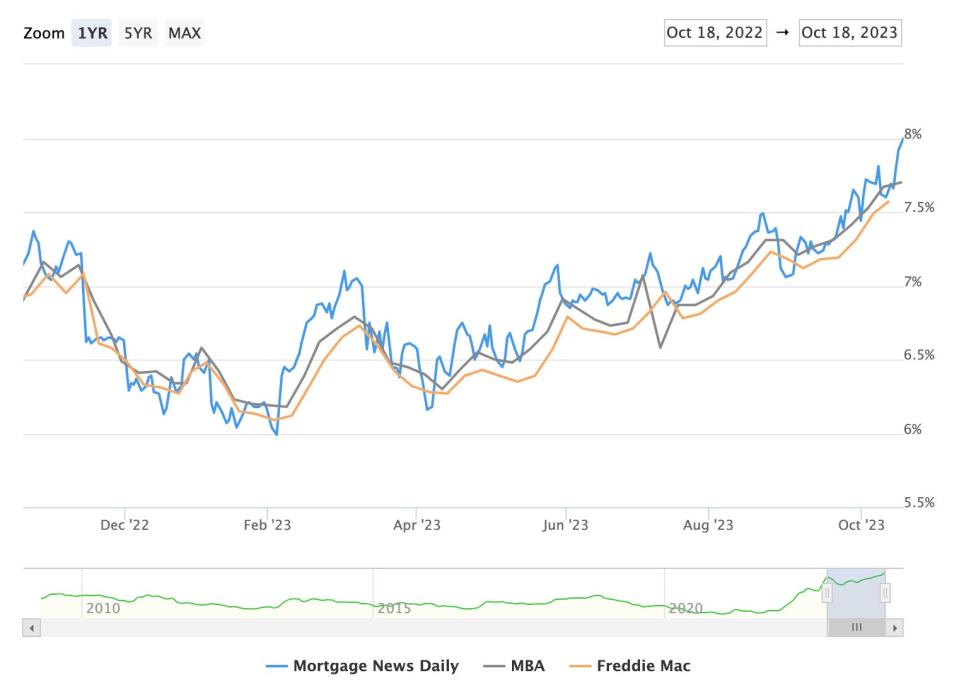

The impact of rising yields and higher borrowing costs is already being felt in certain sectors of the economy. The 30-year fixed mortgage rate reached 8% this week for the first time since 2000, negatively affecting the US housing market and causing transaction volume to plummet to a 13-year low. Similarly, 24-month personal loans at commercial banks rose to 12% in August, representing the highest borrowing cost since 2007, as per Federal Reserve data.

In addition, the resumption of student loan payments for 43 million borrowers in October has added to consumers’ financial burdens. According to a recent Morgan Stanley survey, 34% of borrowers said they are unable to make their loan payments. With households possibly depleting their excess savings, a slowdown in consumer spending seems inevitable.

Sources: Financial Times, Business Insider