Receive free Currencies updates

We’ll send you a myFT Daily Digest email rounding up the latest Currencies news every morning.

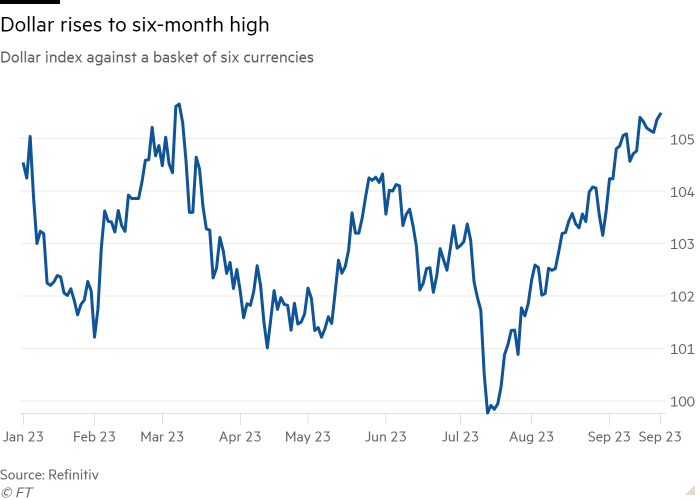

The dollar surged to a six-month peak on Friday, capping off a week of weakness in US stock and bond markets as investors brace for an extended period of high interest rates. This upward trend has resulted in the dollar reaching its highest levels against major currencies such as the euro, pound, and yen, dating back to at least March when the Federal Reserve announced its plans to gradually reduce interest rates. Meanwhile, US government bond prices fell and yields hit a 16-year high, with the S&P 500 index experiencing one of its largest weekly declines this year. The market’s negative response to the Federal Reserve’s decision has solidified the notion that higher interest rates will persist, ushering in a new era of economic conditions.

The Federal Reserve’s decision to maintain current interest rates and express its intention to lower them gradually over the next year and beyond was followed by the Bank of England, which also emphasized the importance of sustained high rates. In a similar vein, the European Central Bank recently raised its benchmark rates to record highs this month. The declining bond prices in the US and eurozone are the result of months of sell-offs in global fixed-income markets due to rising interest rates and inflation.

Some market participants believe that a prolonged period of high interest rates may have a chilling effect on equity markets, as higher borrowing costs could negatively impact the broader economy. Joseph Davis, global chief economist at Vanguard, describes the present situation as unstable, highlighting the historical trade-offs between inflation reduction and economic growth. However, signs that the US is more resilient than other major economies have helped the dollar gain a 6% increase against a basket of other currencies since mid-July.

Furthermore, jobless claims in the US hit their lowest level since January this week, while applications for unemployment aid dropped close to an eight-month low. These positive indicators have led Robert Tipp, head of global bonds for PGIM fixed income, to believe that the US is in a leading position compared to other economies, as the country’s economic prospects are more favorable. In order to curb inflation, which reached over 9% last year, the Federal Reserve has implemented one of its most aggressive monetary tightening cycles in recent history, raising rates by 5.25% over the course of 18 months.

On the other hand, European Central Bank chief economist Philip Lane expressed concerns about downside risks to the region’s growth, highlighting weak manufacturing activity and clear signs of a slowdown in services. While the ECB remains open to further rate hikes, the latest purchasing managers’ index data reveals month-on-month declines in output and orders. This has resulted in a weakening euro. Similarly, sterling has also weakened due to weakening service activity, exacerbated by lower-than-expected inflation and the Bank of England’s decision not to raise rates as anticipated.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.