In August, inflation reached its highest monthly increase so far this year, driven by higher prices for energy and various other items.

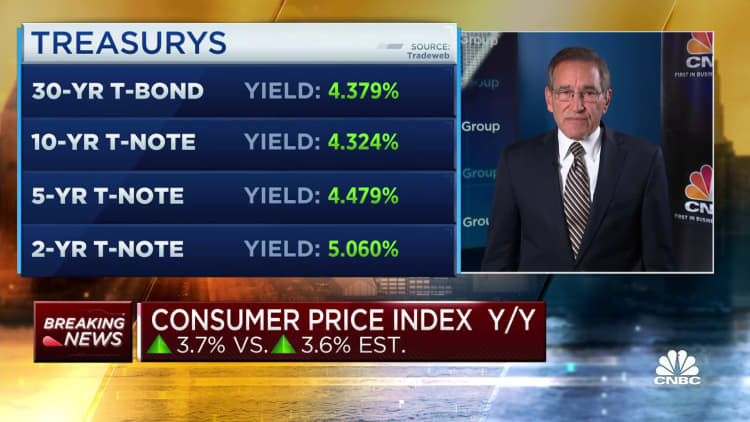

The U.S. Department of Labor reported that the consumer price index, which measures costs across a wide range of goods and services, rose 0.6% on a seasonally adjusted basis for the month. Compared to a year ago, the index increased by 3.7%. Economist surveys anticipated increases of 0.6% and 3.6%, respectively.

However, excluding volatile food and energy prices, the core consumer price index increased by 0.3% for the month and by 4.3% compared to the previous year, surpassing estimates of 0.2% and 4.3%. Many Federal Reserve officials rely on the core index as it provides a better indication of long-term inflation trends.

The increase in energy prices was a major driver, with a 5.6% rise during the month, including a 10.6% surge in gasoline prices.

Food prices rose by 0.2%, while shelter costs, which account for about one-third of the consumer price index weighting, increased by 0.3%. Within the shelter category, the rent of primary residence index rose by 0.5%, marking a 7.8% increase from the previous year. Owners’ equivalent rent, a key measure based on what homeowners believe they could earn in rent, rose by 0.4% and 7.3%, respectively.

In other categories, airfares rose by 4.9% but were still 13.3% lower than a year ago. Used vehicle prices, which had contributed significantly to inflation in 2021 and 2022, declined by 1.2% and fell by 6.6% year-over-year. Transportation services increased by 2% during the month.

According to Lisa Sturtevant, chief economist at Bright MLS, if shelter costs were excluded from the consumer price index, the annual increase would have been only about 1%.

“Housing continues to have a disproportionate impact on inflation measures,” Sturtevant said. “Rent growth has slowed significantly, and median rents nationally decreased year-over-year in August. However, it takes several months for these aggregate rent trends to be reflected in the consumer price index measures, which the Fed must consider in their ‘data-driven’ approach to deciding on interest rate policy at their upcoming meeting later this month.”

Following the release of the report, stock market futures initially dropped but then recovered. Treasury yields increased across the board.

The rise in headline inflation also had an impact on worker paychecks, as real average hourly earnings declined by 0.5% for the month. However, they were still up by 0.5% compared to a year ago, according to a separate release by the Labor Department.

These findings come as the Federal Reserve officials seek to adopt a longer-term strategy to address the issue of inflation. Since March 2022, the central bank has raised its benchmark borrowing rate by 5.25 percentage points to tackle inflation, which had reached its highest level in over 40 years during the summer of 2022.

Recent comments from officials suggest a more cautious approach moving forward. While policymakers had previously favored a more aggressive tightening of monetary policy, they now view the risks as more balanced and appear more cautious about future rate hikes.

“Overall, this report does not change the Fed’s plans to keep interest rates unchanged at the next week’s [Federal Open Market Committee] meeting,” wrote Andrew Hunter, deputy chief U.S. economist at Capital Economics.

Markets widely expect the Fed to refrain from raising rates at the upcoming meeting. However, futures pricing has been volatile beyond that, with traders indicating a 40% probability of a final rate hike in November, according to CME Group data.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.