The proposed changes to the pension system for military and uniformed personnel (MUPs), which include soldiers, police, firefighters, and prison staff, may be seen as a disservice to their dedication and sacrifices for the country. These benefits were established 75 years ago through Republic Act No. 340, shortly after World War II ended. This law ensured a comfortable retirement for MUPs by providing automatic promotion upon retirement and a monthly pension linked to the base pay of active personnel with the same rank. Additionally, the government was responsible for fully funding the pension of MUPs, unlike private employees and civilian government workers who contribute to their pension systems.

Fast forward to 2023, and the budget required for MUP pensions has surpassed the budget for their day-to-day operations. Over the span of 10 years, pension expenditures for MUPs have doubled from P64.2 billion in 2013 to P128.6 billion in 2023. While the monthly pension for retirees doubled after the base salaries of active MUPs were increased in 2018, the national budget has not experienced the same growth.

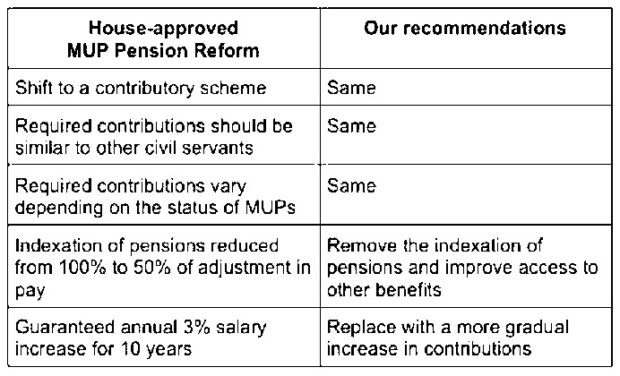

In order to ensure a sustainable source of pensions for current and future MUP retirees, President Marcos has made pension reform a priority for his administration. A bill addressing this issue has recently been passed in the House, with the following points of agreement:

1. MUPs should contribute to their pension fund, as is the practice in other Asean-5 countries such as Indonesia, Malaysia, Thailand, and Singapore.

2. The automatic salary deduction for MUP pensions should be in line with that of other civil servants, with MUPs contributing 9 percent and the government contributing 12 percent.

3. Required contributions should vary based on the status of MUPs, with new recruits contributing 9 percent and those in active service gradually increasing their contribution until it reaches 9 percent. Retired MUPs and those nearing retirement or who have served for at least 30 years would no longer be expected to contribute.

However, it is important for lawmakers to consider certain modifications due to the bill’s fiscal implications. First, the indexation of pension payments to the base pay of active personnel should be removed, as it is not a common practice in developing countries and may lead to the failure of the MUP trust fund. Instead, alternative measures such as expanding access to healthcare and housing benefits should be explored to ensure a comfortable retirement for MUPs.

Second, the required deductions for active personnel should be implemented gradually. The current bill suggests a 5 percent contribution for the first three years, 7 percent for the following three years, and 9 percent thereafter. To ease the transition for MUPs, the proposed reform guarantees a 3 percent annual salary increase for active personnel over the next 10 years. However, it would be more beneficial to start with a smaller deduction (1 to 2 percent) in the first year, with a gradual annual increase of 1 percent to help MUPs and their families adjust their household budgets.

It is evident that reforming the MUP pension system is necessary for the long-term fiscal health of the country and the well-being of MUPs. However, it is crucial for policymakers to reconsider the short-term fiscal implications of the current proposed reform, especially considering the ongoing pandemic and other economic challenges.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.