Nvidia, the leading graphics processor manufacturer, is experiencing unprecedented success with no signs of slowing down. This article explores the reasons behind Nvidia’s soaring popularity and the impressive financial growth it has achieved.

The demand for Nvidia’s highest-end AI chip, the H100, is currently surging among tech companies seeking to develop artificial intelligence applications like ChatGPT. As a result, Nvidia’s overall sales for its second fiscal quarter, which ended on July 30, reached a staggering $13.51 billion, reflecting a remarkable year-over-year growth of 171%. Notably, the company’s gross margin expanded by over 25 percentage points to an impressive 71.2% compared to the same quarter in the previous year, a remarkable feat for a physical product like AI chips.

Moreover, Nvidia anticipates that the high demand for its products will persist throughout the following year. The company has also taken steps to secure increased supply, enabling it to further enhance its chip inventory for the upcoming months. These positive developments have resulted in a more than 6% surge in Nvidia’s stock after-hours, contributing to its phenomenal year-to-date increase of over 200%.

In terms of financial performance, Nvidia reported an astounding $6.7 billion net income in the quarter, marking a remarkable 422% surge compared to the same period last year. Analyst Chaim Siegel from Elazar Advisors has expressed immense optimism, stating that Nvidia’s exceptional performance has prompted him to revise his projections significantly higher. He now sets a price target of $1,600, envisioning a threefold increase from the current level, while still considering his estimates to be relatively conservative.

While Nvidia thrives financially, its major customers, such as Microsoft, continue to heavily invest in AI hardware and multimillion-dollar AI models without yet reaping substantial returns from these technologies. Approximately half of Nvidia’s data center revenue is derived from cloud providers, followed closely by major internet companies. The growth in Nvidia’s data center business primarily emanates from the substantial increase in demand for compute-intensive AI chips, which experienced a remarkable 195% growth during the quarter, surpassing the overall business growth of 171%.

Additionally, Meta, a significant customer of Nvidia’s H100 GPUs, has committed to spending up to $30 billion on data centers this year, with the possibility of increased expenditure in the following year as it focuses on advancing AI technology. Nvidia revealed that Meta is already witnessing the benefits in the form of heightened engagement.

The significance and profitability of Nvidia’s data center chips were emphasized during an earnings call, where Nvidia officials provided insights into the company’s operations. Nvidia attributed its robust margin to the value contributed by its software and the complexity of its products, which extend beyond basic silicon. Analysts cite Nvidia’s AI software, Cuda, as a major reason why customers find it challenging to switch to competitors like AMD.

Notably, Nvidia is actively developing intricate and costly systems like its HGX box, which integrates eight H100 GPUs into a single computer. Constructing these boxes involves an intricate supply chain comprising around 35,000 components. Reports suggest that the price of an HGX box can reach $299,999, significantly higher than the volume price of a single H100, estimated at $25,000 to $30,000 according to Raymond James.

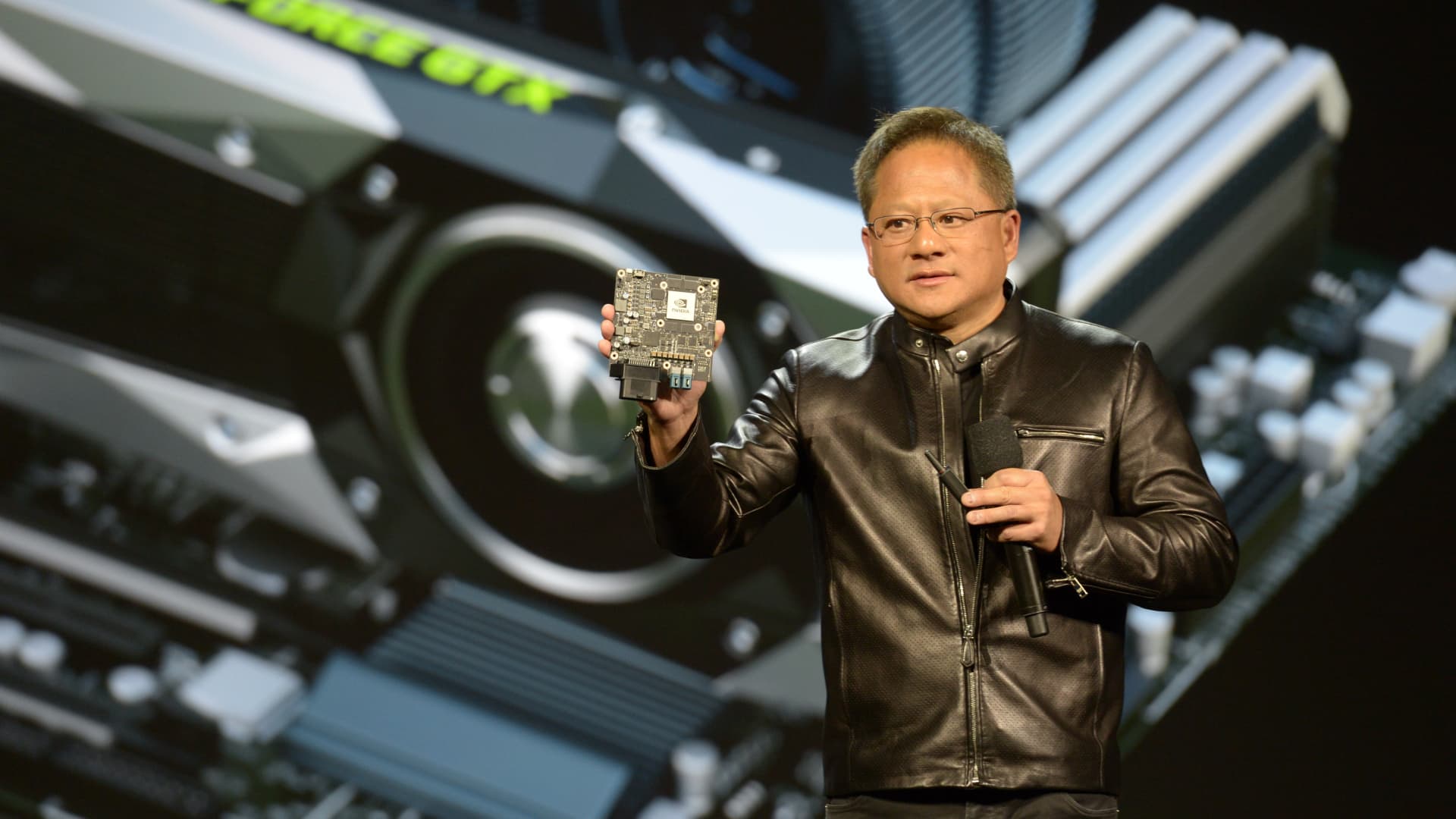

As Nvidia continues to supply its highly sought-after H100 GPUs to cloud service providers, it has observed their preference for the more comprehensive HGX system. Nvidia’s CEO, Jensen Huang, explained during the earnings call that the H100, while presented as an individual chip, is predominantly deployed as part of the larger HGX to cater to the requirements of hyperscale data centers.

In conclusion, Nvidia’s remarkable success in the AI boom distinguishes it as the primary beneficiary in this space. Its exceptional financial growth, reinforced by soaring sales and substantial profit margins, solidifies Nvidia’s position as the frontrunner. With an optimistic outlook for the future and a strong foothold in the market, Nvidia continues to dominate the AI industry with its cutting-edge products and software solutions.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.