Los Angeles — The cool air in the community room of Robin Line’s apartment building in South Los Angeles provides a much-needed relief. However, despite this, Line’s July electric bill increased by a staggering 46%. Living on a fixed income, she is struggling to meet her basic needs.

“Every week, I have to choose between buying milk or eggs. It’s incredibly difficult,” Line shared with CBS News.

The record heat in summer is expected to raise energy costs by nearly 12%, as reported by the National Energy Assistance Directors Association. This increase poses a significant financial burden for many families.

“Research indicates that lower-income households experience a higher inflation rate,” explained Rodney Ramcharan, a finance professor at the USC Marshall School of Business. “These individuals are feeling the impact at around 5% to 6%.”

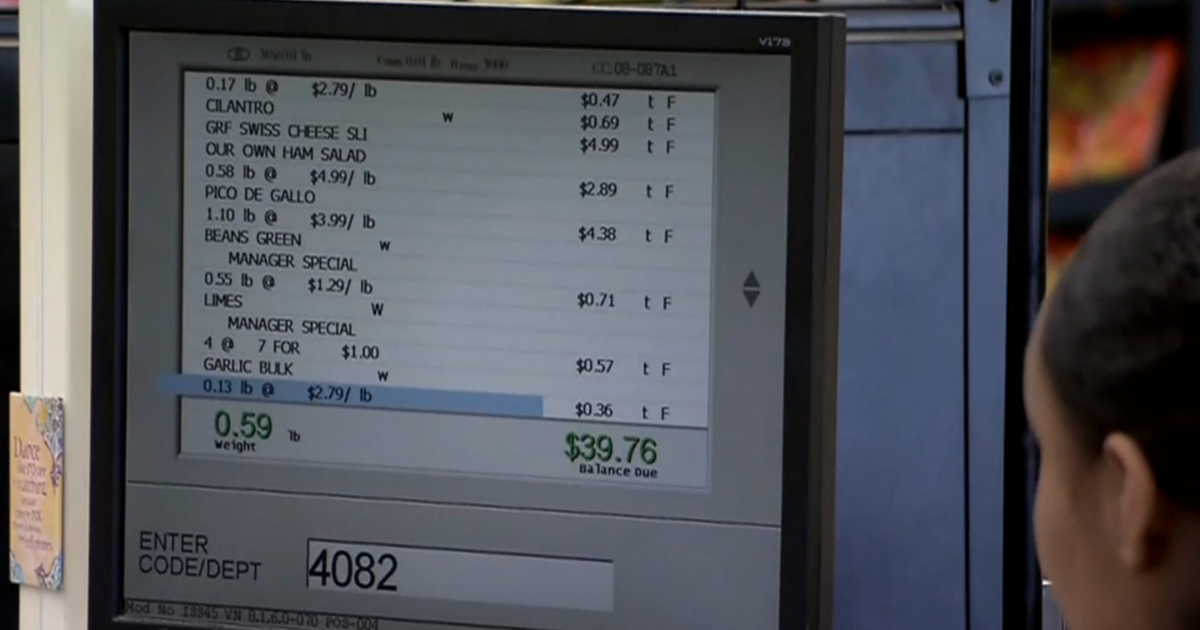

The reason for this is that most of a low-income family’s budget is allocated to essential expenses, which continue to rise. Over the past year, rent has increased by 8%, groceries by 3.6%, and electricity by 3%, according to the U.S. Bureau of Labor Statistics.

Furthermore, there is evidence to suggest that people are relying on credit cards to cover their bills. The Federal Reserve Bank of New York’s Center for Microeconomic Data released a report stating that credit card debt in the U.S. has exceeded $1 trillion for the first time. Greg McBride, Chief Financial Analyst at Bankrate.com, revealed that emergency and unplanned expenses were the leading cause of credit card debt, with everyday expenses accounting for about one in four cases. This trend reflects financial strain among households.

Unfortunately, Line is unable to pay her bills with a credit card and admits to being already delinquent on at least one bill.

In July, inflation rose at an annual rate of 3.2% according to the Labor Department. Although this marked the end of 12 consecutive months of disinflation, it was significantly lower than the staggering 8.5% inflation rate in July 2022.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.