Debating the Future of Monetary Policy: Avoiding Mistakes and Ensuring Economic Stability

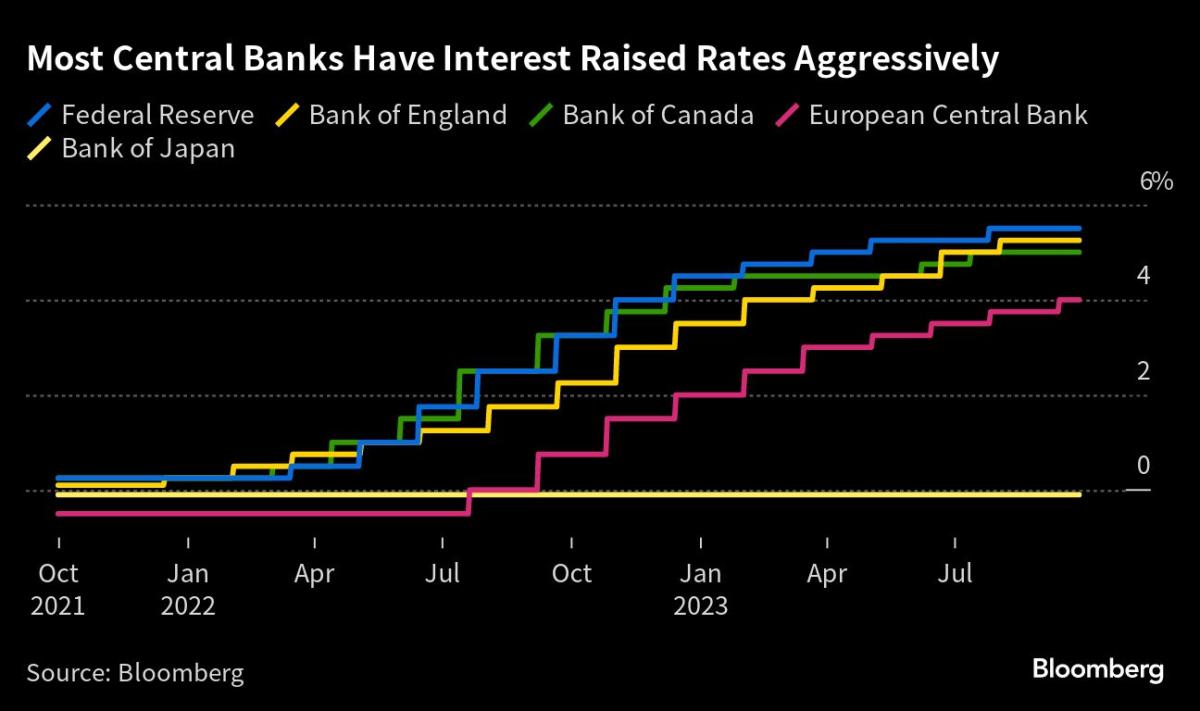

After implementing the most aggressive monetary-tightening campaign in four decades, economists and practitioners are conducting analyses to identify what could have prevented the current cost-of-living crisis. Their goal is to learn from these mistakes and develop strategies to avoid similar situations in the future.

The Inflation Target Debate and Flexible Monetary Policy

One of the ongoing debates among central banks is how flexible they can be in reaching their inflation targets. Economists believe that as long as people have confidence that prices will eventually return to a 2% inflation rate, central banks can be more lenient in their pursuit of that goal.

A global survey of economists from 16 major central banks revealed that policymakers are willing to allow more time to bring inflation back to target if it minimizes harm to their economies. Some economists even suggest tolerating slightly stronger or weaker price pressures, as long as expectations remain stable.

While some experts argue for raising the inflation target, they acknowledge that central banks must first regain credibility by achieving a 2% inflation rate. Changing the goal without achieving it would be a mistake, according to Bundesbank President Joachim Nagel.

Rethinking Quantitative Easing (QE)

Since the 2008 financial crisis, central banks around the world have deployed trillions of dollars in asset purchases, known as quantitative easing (QE), to boost inflation. However, QE has been criticized for distorting financial markets and contributing to episodes like the Silicon Valley Bank blow-up.

Only 40% of economists surveyed expect central banks to continue using QE in the same manner as before. A quarter predict a more conservative use of QE, while around 30% see it primarily as a tool for addressing financial stability concerns. There is even a small minority that believes QE will not be used again at all.

Unwinding balance sheets and reducing holdings can also pose challenges for central banks. Small mistakes in this process can trigger market turbulence, as experienced by the Federal Reserve between 2017 and 2019. The European Central Bank also faces legal hurdles due to its bond holdings in a currency union of 20 countries.

The Merits of Monetary-Fiscal Coordination

Low interest rates and large-scale QE programs have allowed governments to finance stimulus campaigns and prevent economic collapse. However, the extensive spending during and after the pandemic has contributed to the current surge in inflation.

Governments are concerned that tightening policies too aggressively could lead to voter dissatisfaction and the rise of populism or extremism. This raises questions about whether central banks can achieve price stability on their own.

While some economists believe that close coordination between monetary and fiscal policy is necessary, others, like Federal Reserve Chair Jerome Powell, emphasize the importance of central banks delivering price stability regardless of fiscal policy. Central bankers warn that failure to scale back fiscal spending may lead to even higher interest rates.

Ultimately, economists and policymakers agree that a change in mindset is needed, with a greater emphasis on structural policies for sustainable economic growth.