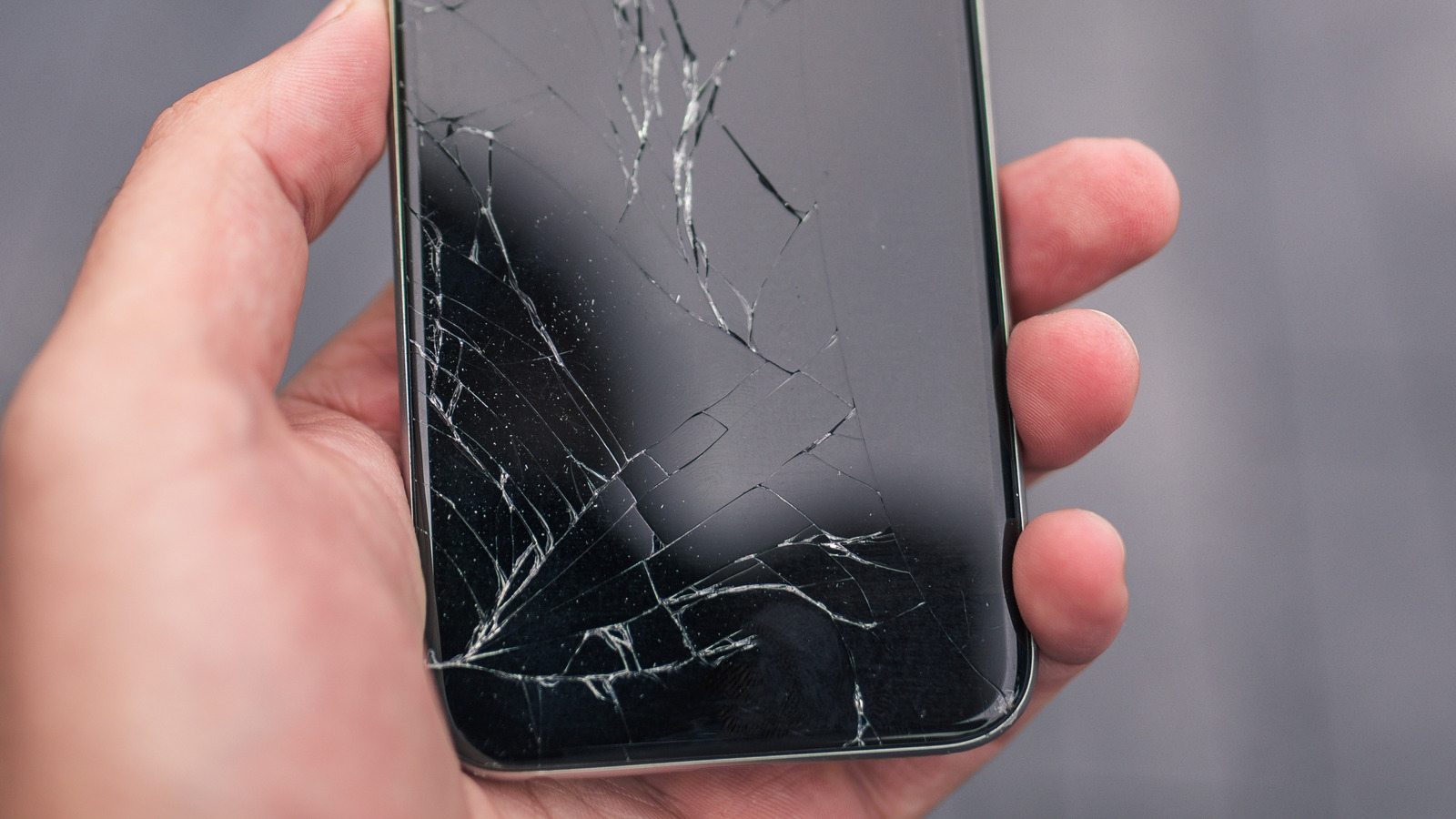

Ensuring your phone and other gadgets are protected requires more than just having an insurance policy. To truly understand what’s covered, you must delve deep into the specifics of your policy by scrutinizing the fine print. While renters insurance generally provides coverage for handheld electronic devices, it’s crucial to note that they are only protected up to the limit specified in the policy.

When evaluating your policy, pay close attention to the limit of liability for electronics. This limit determines the maximum amount you can receive in the event of loss or damage to devices such as smartphones, laptops, and tablets. Being aware of this limit will help you gauge the extent of coverage you can expect in cases of theft or damage.

For instance, let’s say you obtain a policy with a $15,000 cap for personal belongings, but it only covers electronic equipment up to $2,000. When considering the value of your gadgets and factoring in your deductible, you might find yourself responsible for a substantial sum if these items are stolen or damaged.

Moreover, it’s essential to note that most insurance policies exclude coverage for accidental damage or loss unless you opt for additional coverage. Therefore, carefully scrutinizing exclusions before selecting a plan becomes imperative.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.